Overview

I am a Clinical Professor at the Stern School of Business, New York University. I teach and consult extensively about business drivers, financial reporting and analysis, data analytics, modeling, and taxation. I have been at Stern since 1998. I was voted “Professor of the Year” twice and nominated seven times.

Education and Experience

Education

- 1994

- Ph.D. in Accounting with a minor in Information Systems, Tepper School of Business, Carnegie Mellon University, USA

- 1992

- M.S. in Accounting, Tepper School of Business, Carnegie Mellon University, USA

- 1990

- M.S. in Information Systems, Tepper School of Business, Carnegie Mellon University, USA

- 1988

- M.B.A., Indian Institute of Management, Calcutta, India

- 1986

- B.S. in Electronics and Communication Engineering, Indian Institute of Technology, Varanasi, India

Experience

- 2017-

- Clinical Professor of Accounting, Stern School of Business, New York University

- 2004-17

- Clinical Associate Professor of Accounting, Stern School of Business, New York University

- 1998-04

- Assistant Professor of Accounting, Stern School of Business,

New York University

- 1993-98

- Assistant Professor of Accounting, William E. Simon

Graduate School of Business, University of Rochester

- Consultant to various banks, audit firms, and corporations

Teaching

Click here for my teaching ratings at Stern.

Number of different courses taught excluding Excel bootcamps: 23

Total number of individual sections taught excluding Excel bootcamps: 297

Total number of students taught by the end of Fall 2023 excluding Excel bootcamps: 13,426

I have also taught in the Columbia EMBA program as a visiting faculty.

Teaching Materials and Affordability

I have not required a textbook for any of my courses except the “Individual Taxation” course at Stern. All my materials have been free to the students. I do not charge my Stern students for access to the extensive materials and assessment system at Almaris.com to avoid any conflict of interest.

Teaching Awards

- 2022

- “Favorite Professor of the #SternEMBA Class of 2022! ...”

-

- 2018-13, '03, '01

- Finalist for the Professor of the Year Award at the Stern School

of Business, New York University

- 2004, '02

- Winner of the Professor of the Year Award at the Stern School of Business, New York University

- 2008

- Pedagogical Innovation Award at the Stern School of Business, New York University

- 2002-98

- Member of Club 6 (instructors whose ratings exceed six on seven) at Stern

- 1997

- Member of the Dean's List of the Top Five instructors at the William E. Simon Graduate School of Business, University of Rochester

- 1996

- Superior Teaching Award, William E. Simon Graduate School of

Business, University of Rochester

Teaching Interests

Click here for the schedule of upcoming courses by semester.

Accounting and Financial Statement Analysis

- MBA & UG

- Financial Accounting and Reporting

- MS in Accounting

- New in 2018: Financial Reporting and Analysis Bootcamp

- MS in Accounting

- New in 2017: Acquisitions, Deferred Taxes, Translations, and Derivatives

- Tech MBA

- New in 2018: Managing Money Flows

- UG

- Financial Statement Analysis and Valuation

- MBA & UG

- New in 2020: Analysis of Financial Institutions taught with Steve Ryan

Modeling and Projecting Financial Statements

- MBA

- Modeling Financial Statements

- MBA & UG

- New in 2015: Modeling Corporate Transactions

Interarea: Strategy, Marketing, Analysis

- MBA, EMBA, & UG

- New in 2013: Business Drivers: An Analytical Framework

- MBA & UG

- New in 2017: Tech Industry Drivers: An Analytical Framework

- MBA

- New in 2017: Narratives and Numbers taught with Scott Galloway

- Trium EMBA

- New in 2017: Strategic Analysis taught with Sonia Marciano

- MBA & UG

- New in 2020: Renewable Energy and Electric Vehicles Industries

Taxation

- MBA & UG

- Taxes and Business Strategy

- UG

- Individual Taxation

Precollege and Experiential Learning

- Stern Precollege

- New in 2013: Essentials of Business and Investments

- UG

- New in 2013: Accounting and Analysis in Practice

Financial Data Analytics and Computing

- MBA & UG

- New in 2019: Financial Statement Analytics using Python

- UG

- New in 2020: Introduction to Programming and Data Science

- MBA, EMBA, & UG

- New in 2016: Advanced Excel for Business Workshop

Tandon Finance and Risk Engineering (FRE)

- Tandon FRE

- New in 2019: Financial Statements: Modeling and Analytics

- Tandon FRE

- New in 2020: Valuation for Financial Engineering

Stern Executive Programs

- July 2020

- 3-day NYU Stern Executive Programs course on Business Drivers of Industries

- 2013, ‘12, ‘10

- Accounting for credit analysis for Standard and Poors, New York, USA, and London, UK

- 2010

- Finance for Executives at Tatas, Pune, India

- 2009

- Analysis for China Southern Bank, New York, USA

Electronic Materials Development

- 1990

- Developed an automated trading system at Carnegie Mellon, which has been used as a platform for research and teaching in understanding markets

- 1995-

- Develop and update the Financial

Accounting Tutor, a comprehensive interactive software

package to teach financial accounting. John Wiley published the software. The software helps students learn

basic accounting concepts independently, thereby freeing up class

time to discuss managerial issues.

- 2004-

- Develop and update Almaris Online Assessment system. This system provides unique features to evaluate long accounting and finance problems. Most commercial systems work only with multiple-choice and single numeric input problems.

Consulting

I have taught numerous training programs at corporations, investment banks, hedge funds, and private equity shops.

I have also consulted extensively with these organizations. For details about my consulting and training work, including a list of clients I have worked with, please visit my Almaris.com web page.

Accounting and Financial Reporting

- Deferred income taxes

- Business combinations

- Share-based compensation

- Leases

- Foreign operations

- Statement of cash flows

- Convertible debt

- Asset retirement obligations

- Asset impairments

- Pensions and other post-employment benefits

Valuation and Modeling

- Modeling financial statements

- Forensic accounting and earnings quality analysis

- Mergers, acquisitions, and leveraged buyouts

- Analysis of credit risk

- Debt structuring

Research

Research Interests

Accounting-based valuation, earnings forecasts, contracts, design

of markets, and automated trading

Honors and Awards

- 1993-90

- Deloitte and Touche Foundation Fellow

- 1991

- Richard M. and Margaret S. Cyert Family Fellowship, given to

the doctoral student who “best demonstrates the capacity

for interdisciplinary work of unusual vision, originality, imagination,

and creativity,” Tepper School of Business,

Carnegie Mellon University, USA

- 1991

- Doctoral Consortium Fellow at the American Accounting Association,

Tahoe City, California

- 1991-88

- William Larimer Mellon Fellowship, Tepper School of Business, Carnegie Mellon University, USA

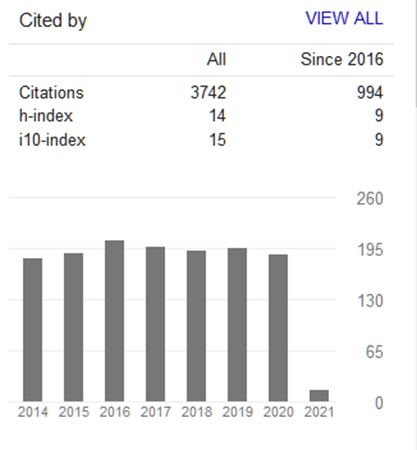

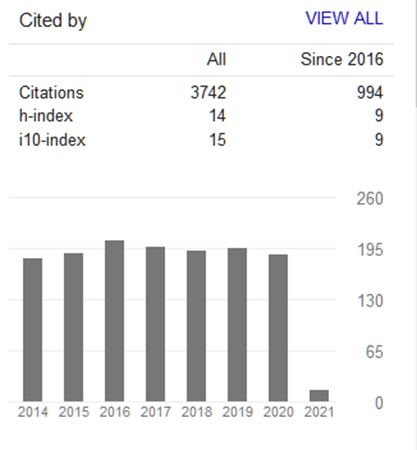

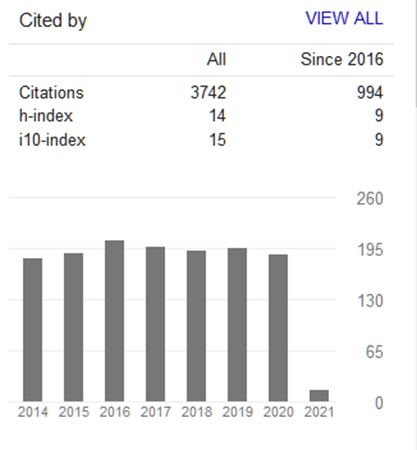

Citations Count from Google Scholar

Link to Google Scholar profile

Data as of February 15, 2021

- 2013

- Mohanram P. and Gode, D. Removing predictable analyst forecast errors to improve implied cost of equity estimates. Review of Accounting Studies, Vol. 18 (2), 443-478

- 2006

- Gode, D. (Dan) K., & Singh, R. (2006). The Impact of Verifiability on Contracts. Journal of Accounting, Auditing & Finance, 21(2), 149–168. https://doi.org/10.1177/0148558X0602100205

- 2005

- Barclay, M., Gode, D.K., and Kothari, S.P., Measuring Delivered Performance, Journal of Contemporary Accounting and Economics, Vol. 1, No. 1, pp 1-26

- 2004

- Gode, D.K. and Sunder, S. Double Auction Dynamics: Structural Effects of Non-Binding Price Controls, Journal of Economics Dynamics and Control, vol. 28, pp 1707-1731

- 2004

- Gode, D.K. and James Ohlson, Accounting-based Valuation with Changing Interest Rates, Review of Accounting Studies, Volume 9, Number 5, December 2004

- 2003

- Gode, D.K. and Partha Mohanram, Inferring the Cost of Capital using the Ohlson-Juettner Model, Review of Accounting Studies, Volume 8, Number 4, December 2003

- 1997

- Gode, D.K. and Sunder, S. What Makes Markets Allocationally Efficient? Quarterly Journal of Economics, May, Vol. 112 (2), 603-630

- 1993

- Gode, D. K. and Sunder, S., Allocative Efficiency of Markets with Zero Intelligence Traders: Market as a Partial Substitute for Individual Rationality. Journal of Political Economy, Volume 101, Number 1, February, 119 137

- 1993

- Gode, D. K. and Sunder, S., Human and Artificially Intelligent Traders in Computer Double Auctions. K. Carley and M. Prietula (Eds.), Computational Organizational Theory, Hillsdale, NJ: Erlbaum (in press). Gode, D. K. and Sunder, S. (1993)

- 1993

- Lower Bounds for Efficiency of Surplus Extraction in Double Auctions. In The Double Auction Market: Institutions, Theories, and Evidence, edited by D. Friedman and J. Rust, Santa Fe Institute Series in the Sciences of the Complexity, Proceedings Volume XV. New York, NY, Addison Wesley

- 1990

- Gode, D. K., Barua, A., and Mukhopadhyay, T., On the Economics of Software Maintenance Problem. Proceedings of the International Conference of Information Systems, Denmark, 159 170

- 2017

- Gode, D.K. and Sunder, S. Convergence of Double Auctions to Contract Curve in an Edgeworth Box

- 2001

- Gode, D. K. and Sunder, S. On the Impossibility of Global Continuously-Clearing

Markets: The Case for Call Markets

- 2002

- Gode, D. K. and Mohanram, P., Inferring the Cost of Capital

using the Ohlson-Juettner Model, Yale School of Management

- 2002

- Gode, D.K., and Ohlson, J., Accounting-based Valuation

with Changing Interest Rates. Rutgers University Business School,

Newark

- 2002

- Gode, D.K., and Mohanram P., Implied Cost of Capital,

USC conference

- 2002

- Gode, D.K., and Ohlson, J., Accounting-based Valuation

with Changing Interest Rates., Carnegie Mellon University Conference

- 2001

- Gode, D.K., and Mohanram P., Implied Cost of Capital NYU-Columbia

Joint Workshop

- 2000

- Gode, D.K., and Mohanram P., What Affects the Implied

Cost of Equity Capital? New York University

- 2000

- Gode, D.K., and Mohanram P., The Relative Use of Earnings

and Stock Prices in CEO Compensation, American Accounting Association

- 2000

- Gode, D.K., and Ohlson, J., P-E Multiples and Changing

Interest Rates. New York University

- 1999

- Gode, D.K. and Sunder, S., Design of Auctions, the University

of Texas at Dallas

- 1999

- Gode, D.K., and Mohanram P., The Relative Use of Earnings

and Stock Prices in CEO Compensation New York University

- 1999

- Barclay, M., Gode, D.K., and Kothari, S.P., Measuring

Delivered Performance, Baruch College

- 1999

- Gode, D.K. and Sunder, S., Design of Auctions, IBM Watson

Research Center

- 1999

- Gode, D. K., Electronic Texts, Lehigh University/Lafayette

College

- 1999

- Gode, D. K., Electronic Texts, Ramapo College

- 1998

- Gode, D. K., Electronic Texts, American Accounting Association, New Orleans

- 1998

- Gode, D. K., Electronic Texts, Rutgers University, Newark

- 1998

- Gode, D. K., Electronic Texts, American Accounting Association,

New Orleans

- 1997

- Barclay, M., Gode, D.K., and Kothari, S.P., Measuring

Delivered Performance, Conference at SUNY Buffalo

- 1997

- Barclay, M., Gode, D.K., and Kothari, S.P., Measuring

Delivered Performance, New York University

- 1997

- Gode, D. K. and Sunder, S., Double Auction Dynamics:

Structural Consequences of Non-Binding Price Controls Economic

Science Association meetings in Tucson

- 1997

- Barclay, M., Gode, D.K., and Kothari, S.P., Measuring

Delivered Performance, Harvard Business School

- 1997

- Gode, D. K. and Sunder, S., Double Auction Dynamics:

Structural Consequences of Non-Binding Price Controls American

Economic Association Meetings in New Orleans

- 1996

- Barclay, M., Gode, D.K., and Kothari, S.P., Earnings versus

Price Changes: Delivered versus Expected Performance, Department

of Accounting, SUNY Buffalo

- 1996

- Barclay, M., Gode, D.K., and Kothari, S.P., Earnings versus

Price Changes: Delivered versus Expected Performance, Simon School

of Business, University of Rochester

- 1996

- Gode, D. K. and Sunder, S., What Makes Markets Allocationally

Efficient? At the Department of Accounting, University of Minnesota

- 1995

- Gode D.K., Future of Markets-Based Research in Accounting.

Member of the panel discussion with Professors William Beaver

and Joel Demski at the American Accounting Association, Annual

Conference

- 1993

- Gode, D. K. and Sunder, S., What Makes Markets Allocationally

Efficient? At the Department of Economics, University of Rochester

- 1993

- Gode, D. K. and Sunder, S., What Makes Markets Allocationally

Efficient? At the Accounting and Finance Conference, Washington

University, St. Louis, October 1993

- 1993

- Gode, D. K., Joint and Several Liability of Auditors.

At the Accounting and Finance Conference, Washington University,

St. Louis, October 1993

- 1992

- Gode, D. K. and Sunder, S., Some Issues in the Electronic

Modeling of Continuous Double Auctions with Computer Traders.

Conference on Computational Economics, IC2 Institute, the University

of Texas at Austin

- 1991

- Gode, D. K. and Sunder, S., Lower Bounds for Efficiency

of Surplus Extraction in Double Auctions. Meetings of the Economic

Science Association, Tucson, Arizona

- 1990

- Gode, D. K. and Sunder, S., Electronic Stock Exchange

and Trading System. IBM Academic Computing Conference, Miami

- 1989

- Gode, D. K. and Sunder, S., Human and Artificially Intelligent

Traders in Computer Double Auctions. Meetings of the Economic

Science Association, Tucson, Arizona